FreeUp Storage DFW Portfolio

This is an amazing value-add portfolio of 18 facilities!

18 Facilities

Value Add with Expansion Potential

High Growth Market

1.88X - 1.98X

Targeted Equity Multiple

15.0% - 16.2%

Targeted IRR

7.5%

Preferred Return

17.5% - 19.5%

Target Annual Return

Investment Opportunity

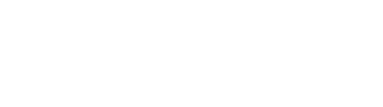

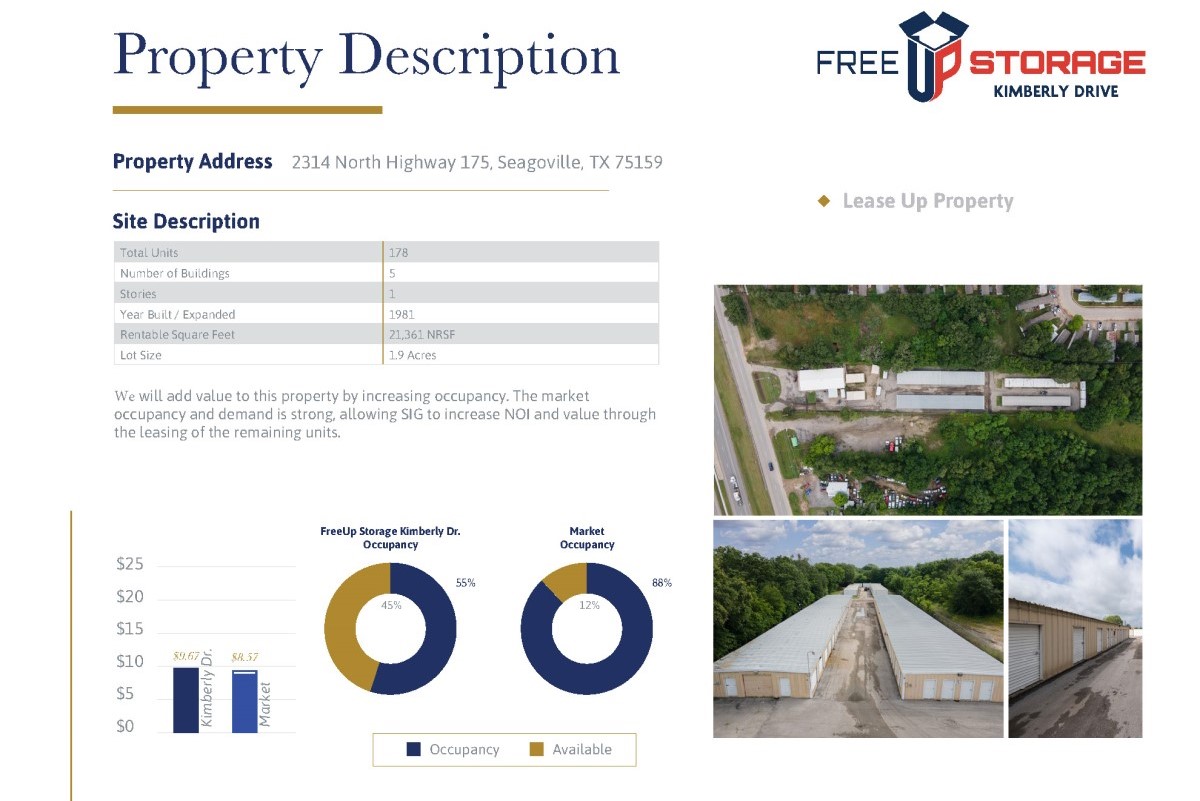

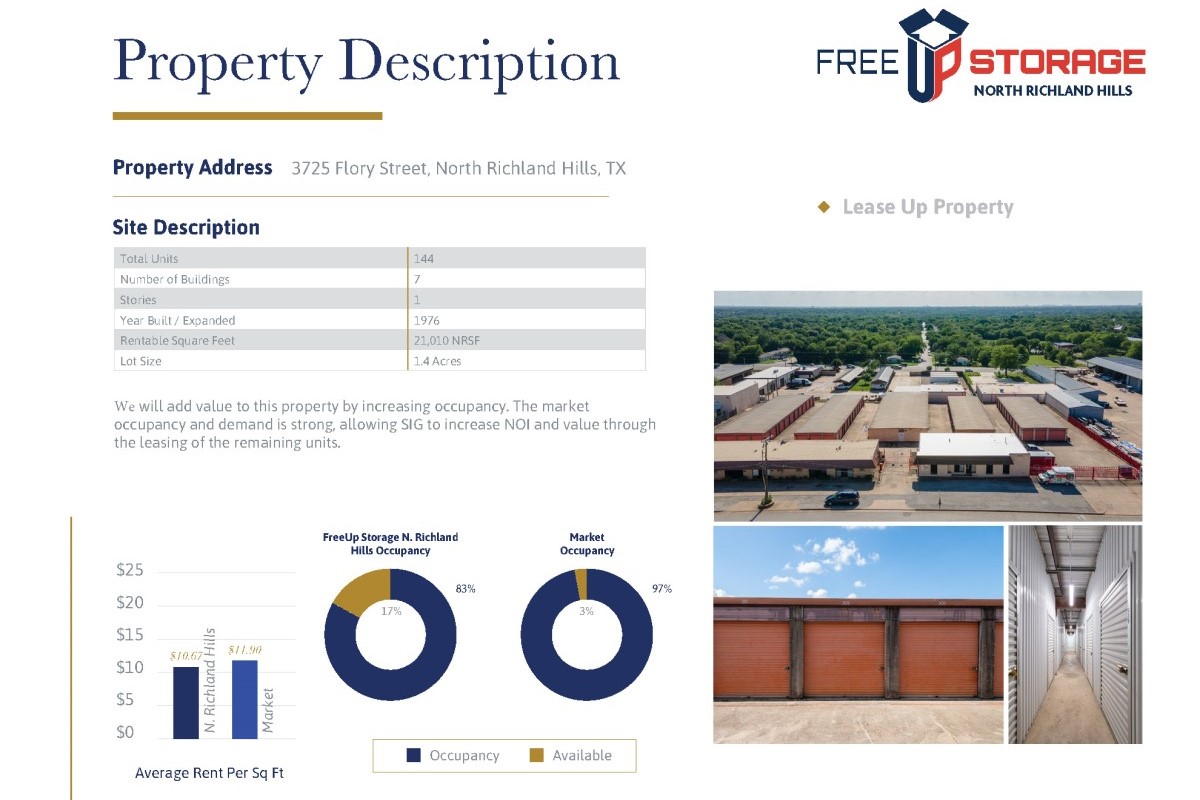

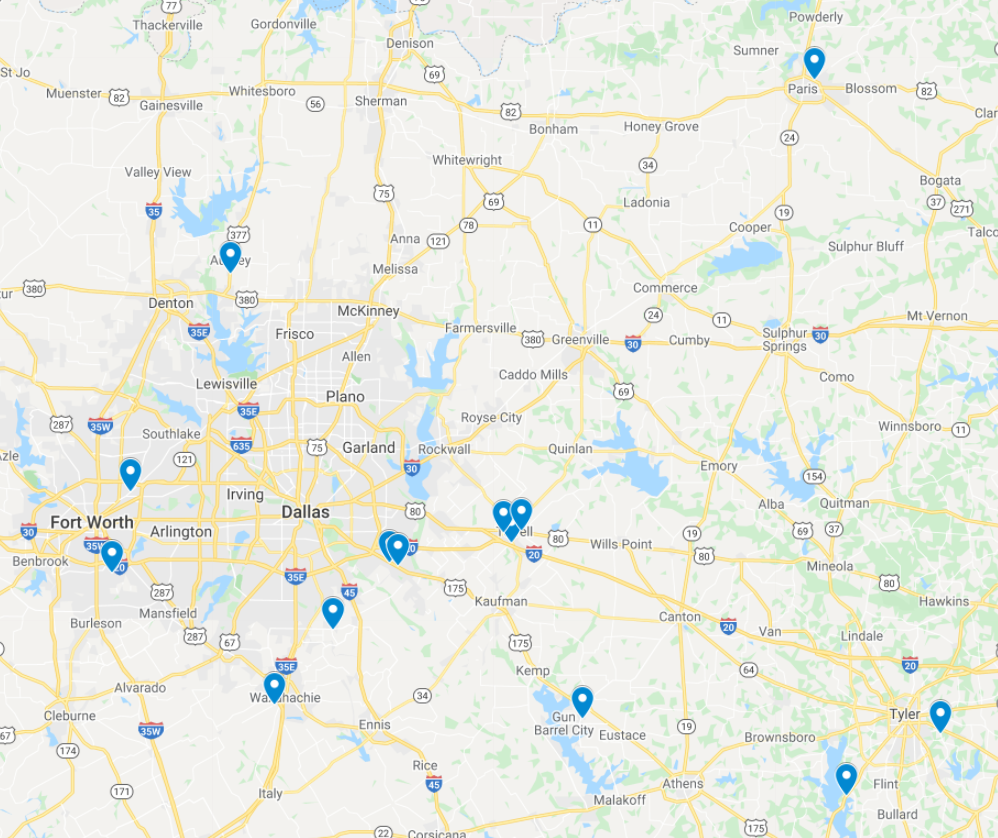

This offering consists of a value-add portfolio with scale and significant upside through expanding sites, implementing revenue management, rate increases, and added management efficiencies. The properties are strategically situated throughout Dallas-Fort Worth and east Texas where SIG/FreeUp Storage owns and operates numerous store locations.

Over 1.3 million people have moved to DFW over the past 10 years fueling demand for storage. Texas, and specifically DFW, have seen extraordinarily high volumes of new population growth due in part to the suburbanization trends that have been playing out all across the country.

The FreeUp Storage DFW Portfolio provides investors with projected day 1 cash flow and significant upside potential.

Why You Should be Interested

Recession-Resistant Asset Class

Self-storage stands apart from many other sectors in the commercial real estate space. During a recession, many property types tend to lose tenants and suffer from reduced cash flow and lower rents. Self-storage is not nearly as affected because storage needs actually increase in a recession, there is less reliance on individual tenants and significantly less maintenance/operations costs than other asset types.

Portfolio Overview

3,200 sq ft of office space

45,000 sq ft of warehouses

Dallas-Forth Worth, TX

The DFW area (Dallas, Fort Worth and Arlington Metropolitan Statistical Area or MSA) covers 9,286 square miles as the 4th-largest MSA in the United States with a population of 7.4 million, and the 12th largest MSA in the world.

From 2010 to 2019 the Dallas Metro gained 1.3 million residents, ranking 1st among all U.S. MSA’s. For 2020 to 2029, the Dallas Metro is projected to add 1.4 million residents, and once again rank among the fastest growing metro areas.

The Self-Storage Asset Class

We understand that self-storage isn’t what most investors would consider “sexy.” Sure, it may not have drywall, carpet, or HVAC, but from an investment and ROI standpoint, self-storage is one of the best investments in the US. Here’s why:

Meet The Management Team

Scott Meyers

CEO, Kingdom Storage Partners, LLC

Scott Lewis

CEO, Spartan Investment Group, LLC

Ryan Gibson

CIO, Spartan Investment Group, LLC

Ben Lapidus

CFO, Spartan Investment Group, LLC

Properties Overview

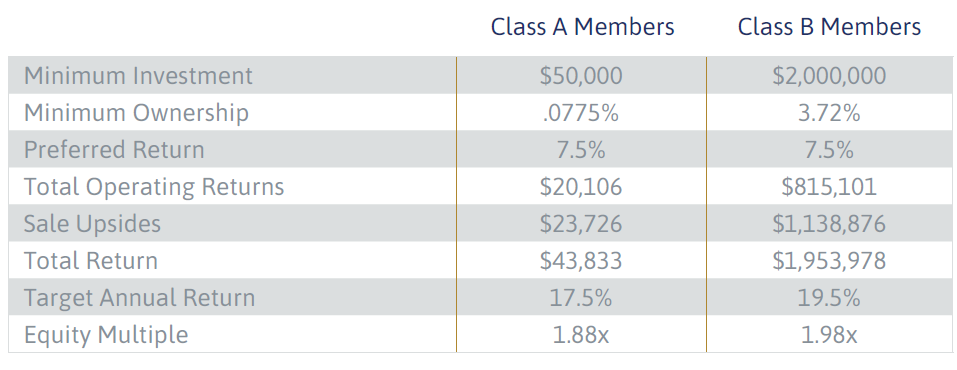

Return Analysis

The intent for this project is to offer our investors two types of returns: monthly cash flow and a payout upon the sale or recapitalization of the property. The total ROI presented below is based on our preferred course of action, which is to get the property expanded, stabilized, and sold to return initial investor capital in addition to gains from the liquidity events.

What You’ll Learn in the Investor Kit

Bottom line, this is an excellent opportunity in an excellent MSA. Coupled with our world-class management team, experienced in self-storage, and projected day 1 returns, it’s hard to imagine this investment being anything but a slam-dunk for our investors!

We think you’ll be blown away when you discover all the details of this investment on the investor call. Here’s what we’ll cover:

Our strict investing criteria and process.

This is an exciting new self-storage investment opportunity with potential for strong returns. We can’t wait to share this enormous opportunity with you in the presentation!

Kingdom Storage Partners, LLC Syndication Benefits

Syndication Leverage

Tax-Advantaged Investing

Capital Appreciation

Recession Resistant

1.88X - 1.98X

Target Equity Multiple

15.0% - 16.2%

Target IRR

7.5%

Preferred Return

17.5% - 19.5%

Target Annual Return

Access The Full Investor Kit

Included in the Investor Kit is a replay of the live investor webinar, offering memorandum/slide deck, and investor portal registration where you can gain access to the due-diligence documents and invest in this amazing portfolio.

Disclaimer: The Kingdom Storage Partners, LLC website is intended solely for informational purposes. The Kingdom Storage Partners, LLC website does not constitute an offer to sell, or a solicitation of an offer to buy, an interest in a Kingdom Storage Partners, LLC investment opportunity. All information included in this website is believed to be current as of the date hereof and is subject to change, completion, or amendment without notice. The Kingdom Storage Partners, LLC website does not purport to contain all the information necessary to evaluate an investment with Kingdom Storage Partners, any such offer or solicitation will be made only by the delivery of a confidential Private Placement Offering Memorandum (PPM)relating to a particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who are sophisticated in financial matters, and it is understood that you will make your own independent investigation of the merits and risks of any future investment with Kingdom Storage Partners, LLC & partnered operators. All prospective investors are encouraged to conduct their own independent due diligence investigation, review, financial projections, and consult with their legal, tax, and other professional advisors before making an investment decision.

This website may include forward-looking statements. All statements other than statements of historical facts included in this website, including, without limitation, statements regarding the future financial position, targeted or projected investment returns, business strategy, budgets and projected costs, plans and objectives for further operations, are forward-looking statements. Forward-looking statements reflect our current expectations and assumptions as of the date of the PPM, and are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied.