How To Start In Real Estate Investing - Earn Passive Income

Are you interested in learning about the ways you can enhance your investment portfolio to live a cash flow lifestyle? Have you thought about real estate investing but had no idea how to break into it? This guide for getting started in real estate investing will help you earn a passive income and build your portfolio to resemble the investment portfolios of the upper class even if you’re not sure where to start.

Key Benefits Of Self-Storage Investing

Passive Income

What exactly does passive income mean? Basically, you can continue to live your life while the investment property makes you money. Of course, you can become involved in the day to day operations, but you don’t have to. You can take a vacation or sit on the beach while the storage facility is earning a passive income. You will need to hire a management team you can trust to make that possible. The average rental term for a storage facility is 1 to 3 years. Whether there is a recession or not, many people still need storage units. Passive income security is ideal for investors.

Low Overhead

Self-storage facilities require very little maintenance or management, which means they have low overhead and expenses. Most self-storage places have a code at the front to open a gate which is monitored by CCTV. This eliminates the need for a constant security guard. Tenants have keys to their storage units, which they open themselves. You don’t have to worry about tenants causing damage or plumbing issues. Most facilities can get by with just part-time management, which might be cleaning once a week or signing up new tenants.

Tax Benefits

Self-storage facilities immediately decrease federal income tax due to decreased appreciation. You will also get to deduct all of the expenses associated with the facility including property taxes. You might also be eligible for bonus depreciation, which means you can write off a larger portion of the purchase price of the facility within the year you purchased it.

Leverage

Another great benefit is you can use leverage to buy, develop, or invest in a rental property. One hurdle to real estate investing is most people don’t have that much cash to buy a property outright. The good news is you can use leverage to invest in self-storage facilities. You can buy shares in a REIT to minimize the risk and still reap the rewards. You can also take out a loan for an existing facility or develop a new one. Construction loans are often available for new storage facilities.

To read more and invest in your future, unlock the rest of the article below

What can you expect to find in this article..

- Table of Contents

- 9How To Accelerate Your Wealth Building

- 9How Does Each Wealth Bracket Invest Their Money?

- 9Common Investment Asset Classes

- 9Up Vs Down Years

- 9Are Your Taxes A Burden?

- 9How Much Are Your Taxes Costing You In The Long Run?

- 9Benefits Of Getting Started In Real Estate Investments

- 9What Types of Properties Can I Invest In?

- 9How Does Investing In Real Estate Make You Money?

- 9What About High Barriers Of Entry In Real Estate Investment?

- 9Is Self-Storage Investing A Good Way To Overcome Barriers In Real Estate Investing?

- 9Key Benefits Of Self-Storage Investing

- 9What Are The Different Types Of Self-Storage Investments?

- 9How To Get Started In Self-Storage Real Estate Investing

- 9FAQs

- 9The Bottom Line

How To Accelerate Your Wealth Building

Are you interested in investing your money in real estate? This report was designed to help potential investors discover some of the fast facts about how to get involved with real estate investment. This guide will arm you with the information you need to use your wealth in the best way possible. I’ve included information about common asset classes and a quick start guide to help investors understand where their money can be put to best use and work for itself. We know you’re busy, so let’s get started on accelerating your wealth building.

How Does Each Wealth Bracket Invest Their Money?

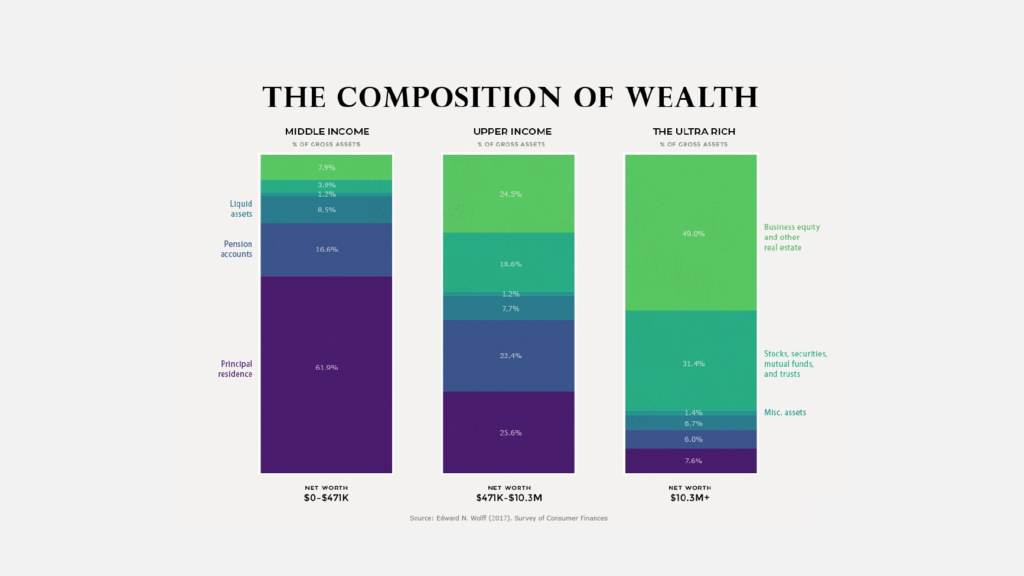

How do I become a real estate investor? The truth is the upper class and ultra-rich invest very differently than other classes. For example, the middle class holds 61.9% of its gross assets in their principal residence. The upper-income class holds roughly 25.6% of their assets in their primary residence. The ultra-rich, on the other hand, hold only 7.6% of their wealth in their primary home. The ultra-rich invest nearly half, 49%, of their gross assets in business equity and other real estate investments. That means they are putting their money to work for them and earning passive income.

Common Investment Asset Classes

Equities

Equities are commonly referred to as common shares or stakes in a real business. Many types of common shares come with fine print which makes the risks and rewards different under each contract. Equity shares in a business mean the shareholder will be paid out their share of the total profit and assets of a company. Many times this payout will be provided to the shareholder in their stockbroker account, so they can reinvest the money back into the business. The reinvestment potential can yield a vast sum if the business is doing well.

Commercial Bonds

This type of investment class helps provide businesses the money they need to start their business. Investors get paid a fixed interest rate from the business. Once the bond has matured, the sum will be paid in full. Sometimes a company’s physical assets will be used as collateral. This type of investment can carry a greater risk if the company does not do well.

Government Bonds

Government bonds are similar to commercial bonds except you loan money to a government for future projects instead of a business. The appeal of government bonds is that they are guaranteed to be paid back, so there is less risk.

Real Estate and Property

How does investing in real estate work? This is one of the best ways for people to get involved and invest like the ultra-rich. Real estate investments can come in many different forms, such as commercial buildings, self-storage, fixer-uppers, and rental properties. Rental properties can provide passive income to an investor. Real estate investing requires a thorough market analysis to understand the risks and rewards. At Passive Storage Investing, we focus on self-storage as a fantastic way to earn passive income with a fraction of the liability and maintenance costs.

Commodities

Commodities are goods used on a global scale such as coal, gold, oil, and gas. An investor buys a large sum of a certain commodity and resells it to manufacturing plants. The main appeal of this class is an investor can buy low and sell high. Since this asset class works on a supply and demand basis, it is difficult to tell if it will appreciate over time or depreciate quickly.

Currencies

Investing in currencies has grown significantly over the past few years, especially with the advent of cryptocurrency. Currencies can appreciate and depreciate over time, sometimes even within one day. Some investors get started in forex trading to buy and sell currencies quickly. The market changes depending on trade and economic growth within a region. Forex trading will not provide substantial long-term portfolio growth.

Highlights of Common Asset Classes

- Government bonds have low risks and low returns

- Commercial bonds have greater returns but risk increases

- Equities are high risk and high return

- Commercial real estate investment has only a slightly higher risk than government bonds but with the highest annualized return rate

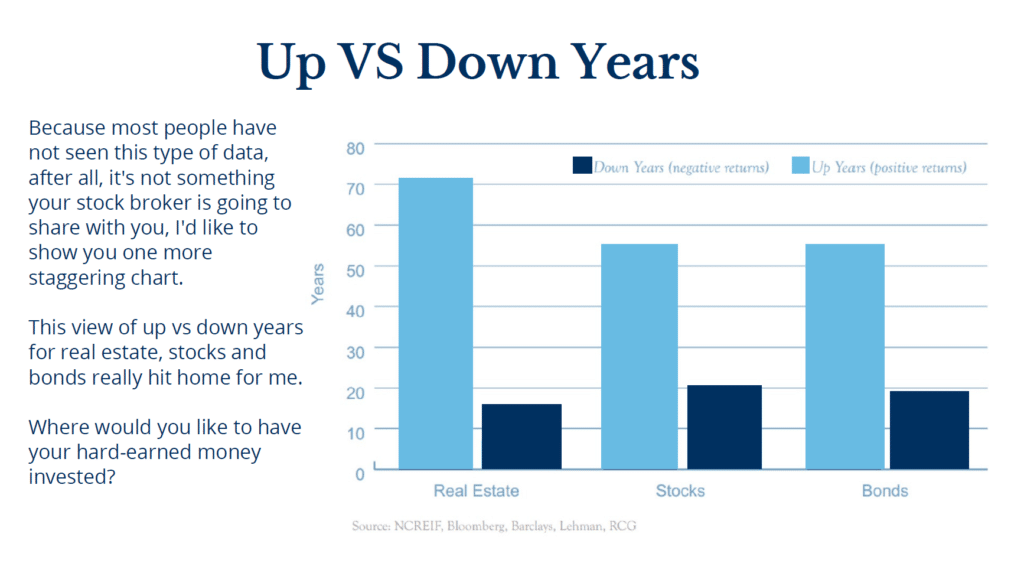

Up Vs Down Years

As a potential investor, I’m sure you are aware that the market for any asset class fluctuates over the years. A bull market is when stock prices are high and many people are investing in a strong economy. A bear market is when stock prices steadily fall. It is important to note real estate has had more up than down years over the past century. Out of approximately 80 years, real estate has had a little over 70 up years. Where do you want to invest your money during these uncertain times?

Are Your Taxes A Burden?

Do you ever feel like you are getting crushed by your taxes when the bill comes? You’re not alone. The average investor’s biggest expense is their taxes. I’ve known so many people who work hard to get ahead of the curve and when the time comes, they receive a huge tax bill. The good news is investing in real estate is a great way to relieve some of your tax burdens.

How Much Are Your Taxes Costing You In The Long Run?

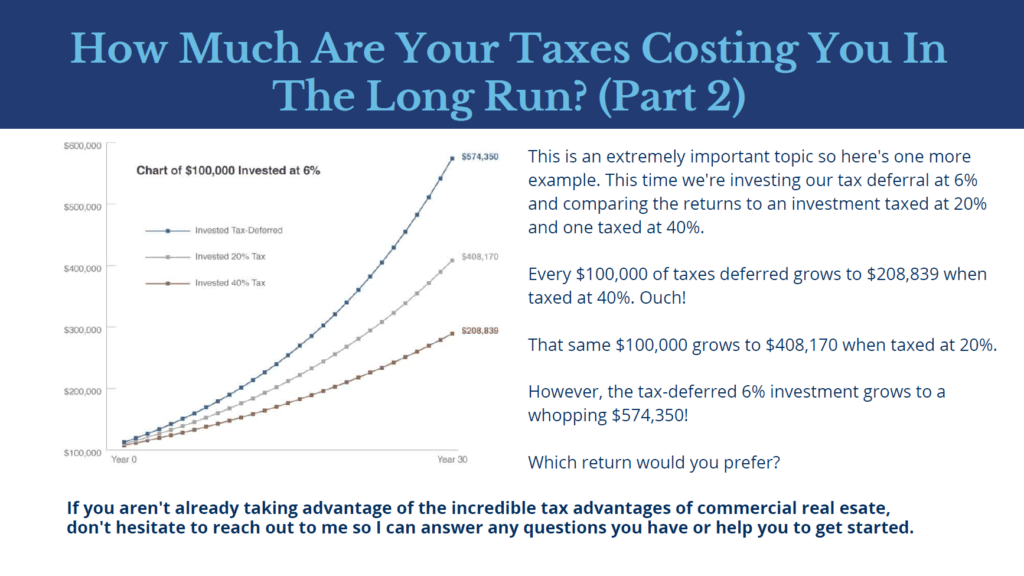

Let’s break this down simply. For every $100,000 you don’t pay in taxes, you can generate $430,000. Here is another example, but this time we will be investing our tax deferral at 6% and comparing returns to an investment taxed at 20% and 40%.

Every $100,00 of taxes deferred grows to $208,839 when taxed at 40%. That same amount when taxed at 20% will grow to $408,170. Now for the real kicker, the tax-deferred 6% investment will grow to $574,350. That’s quite a big difference. If you’re not already taking advantage of commercial real estate tax benefits, reach out to me so I can give you advice on types of real estate and tax advantages for each.

Benefits Of Getting Started In Real Estate Investments

Tax Benefits

As you can see from my previous example, the tax advantages of investing in real estate are hard to beat. The government sees real estate profits as gains, which means they are taxed lower than employment income. Another advantage, if you’re receiving rental income from an investment property, you won’t pay self-employment tax. You will also be able to include the upkeep of your rental property as tax deductions. This might include maintenance costs, property tax deductions, and capital gains deferral.

Leverage

Leverage is one of the major draws for people who are looking to start investing. Potential real estate investors can take out a loan for a property they couldn’t otherwise afford. Once they realize the potential profits of a property, they can leverage capital several times over. Leverage helps the real estate investor build a portfolio and credit score at the same time.

Control

When you start investing in real estate, you gain control over your assets compared to stocks and bonds investments. If you invest money in stocks you just have to passively wait to see a return. Unless you are a major stakeholder in a company, you will have little control over their operations.

With real estate investment, you can control the daily operations of your rental properties. You can control the direct improvements to properties which will increase their value.

What Types of Properties Can I Invest In?

Real Estate Investment Trusts

Real estate investment trusts, REITs, are a great way for investors to break into the real estate market. They allow an investor to buy a share in commercial real estate to share the profits without actually owning or maintaining the property. There are two main types of REITs, publicly-traded ones, and non-publicly traded ones. A publicly-traded REIT is exchanged on a stock market, which means it can be liquidated for cash. Non-publicly traded REITs cannot be easily traded on a stock exchange.

Residential and Commercial Real Estate

Most people are familiar with the concept of buying residential real estate as many of you likely already own a home. Residential real estate offers a solid long-term investment which might be ideal for house flipping, renting out, or simply appreciating value to resell.

Commercial real estate can be large office buildings, self-storage facilities, or factories. Most of the time we associate commercial real estate with renting out to other companies. This means that an investor will have to consider vacancies, property managers, and maintenance costs.

Rental Properties

This category can include apartment buildings, office buildings, single-family homes, and self-storage facilities. Almost any type of property could be a rental property depending on the investor’s intent. Rental properties can bring in a lot of passive income, but they also carry more risk. An investor needs to worry about repair costs, utilities, property management, and vacancy to tenant ratios.

Self-Storage Investing

At Passive Storage Investing, I specialize in providing my clients with expert advice and assistance on owning self-storage facilities. I think they are a great way for investors to break into the market and start living a dependable cash flow lifestyle. You can invest in self-storage facilities by using a REIT or becoming an owner-operator.

How Does Investing In Real Estate Make You Money?

Real Estate Appreciation

So, how do you invest money in real estate and actually make a return? Well, one simple way is you let the property appreciate in value and resell it. Basically, you buy low and sell high. You can rent out the property in the meantime. Most appreciation happens when the real estate market in a particular area is on the rise. This change might be due to general market changes or upcoming areas appreciating.

Cash Flow Income

A passive income is one of the biggest draws for people looking to get started with real estate investments. An investor will buy a rental investment property to collect a stream of cash from the tenants. There might be more costs associated with this type of property, but it is usually worth it for investors. Rental income can be generated from retail spaces, apartment buildings, office buildings, or self-storage facilities.

Ancillary Income

Ancillary income is something you may not have thought of before. This type of income is generated by other items within the facility. This might include vending machines or on-site laundry facilities. It is like operating a business within your rental property.

What About High Barriers Of Entry In Real Estate Investment?

You might be wondering how you can overcome some of the high barriers to entry when it comes to real estate investing. The truth is, real estate investments offer a fantastic opportunity to use leverage to invest in properties. With REITs, investing in commercial real estate is much easier for investors. At Passive Storage Investing, we use our expertise to leverage network connections and industry relationships to assist you with your next investment.

Is Self-Storage Investing A Good Way To Overcome Barriers In Real Estate Investing?

The short answer is yes. Self-storage investment can help you earn passive income without having to worry about tenants, toilets, or trash from each unit. Self-storage units offer leveraged debt opportunities, extraordinary tax benefits, and a hedge against inflation and recession.

Key Benefits Of Self-Storage Investing

Passive Income

What exactly does passive income mean? Basically, you can continue to live your life while the investment property makes you money. Of course, you can become involved in the day to day operations, but you don’t have to. You can take a vacation or sit on the beach while the storage facility is earning a passive income. You will need to hire a management team you can trust to make that possible. The average rental term for a storage facility is 1 to 3 years. Whether there is a recession or not, many people still need storage units. Passive income security is ideal for investors.

Leverage

Another great benefit is you can use leverage to buy, develop, or invest in a rental property. One hurdle to real estate investing is most people don’t have that much cash to buy a property outright. The good news is you can use leverage to invest in self-storage facilities. You can buy shares in a REIT to minimize the risk and still reap the rewards. You can also take out a loan for an existing facility or develop a new one. Construction loans are often available for new storage facilities.

Low Overhead

Self-storage facilities require very little maintenance or management, which means they have low overhead and expenses. Most self-storage places have a code at the front to open a gate which is monitored by CCTV. This eliminates the need for a constant security guard. Tenants have keys to their storage units, which they open themselves. You don’t have to worry about tenants causing damage or plumbing issues. Most facilities can get by with just part-time management, which might be cleaning once a week or signing up new tenants.

Tax Benefits

Self-storage facilities immediately decrease federal income tax due to decreased appreciation. You will also get to deduct all of the expenses associated with the facility including property taxes. You might also be eligible for bonus depreciation, which means you can write off a larger portion of the purchase price of the facility within the year you purchased it.

What Are The Different Types Of Self-Storage Investments?

Storage REITs

Earlier, we discussed the benefits of REITs when it comes to investing in real estate. Self-storage REITs can be a great way to get started with investing in a self-storage facility. You can invest through a publicly-traded market to ensure you can quickly liquidate the asset if necessary. You won’t have as much control over the storage facility if you choose this route, but it is a great way to get started with a smaller investment.

Developing A Storage Facility

This option is the most labor-intensive and will certainly take the longest. It can also produce the most ROI if done correctly. Newly built storage facilities have the most value, but it requires a lot of knowledge and time to make it happen. To build your own facility, you will need to find a plot of land which is large enough and in a good location away from competitors. You should check with the local building authority to make sure you understand their zoning and building codes before you purchase the land.

You should aim to create a storage facility that has the same amenities as other large facilities to attract REIT investors. This might include climate-controlled units and 24-hour access.

Purchasing An Existing Storage Facility

If you choose to purchase an existing storage facility, you will save yourself some time. You can search for storage facilities sales on some of the major websites or hire a real estate agent. When searching for a facility, you should take a look at the cap rate. It will tell the net operating income and the potential return on investment of a storage facility. The higher the cap rate is, the more potential ROI the storage facility will have. You should conduct a full cash flow analysis before choosing a property to purchase.

Financing A Storage Facility

This option works for many investors who are looking to use leverage for their new storage facility. The most popular loans are offered by the Small Business Association (SBA). They offer SBA 504 loans for development and SBA 7a for existing facilities. SBA loans offer attractive interest rates and usually only require the investor to put 10 or 15% for a down payment.

Conventional financing usually requires 20% for a down payment, so it is not quite as popular. You can also look into CRE loans, which include crowdfunding and bridge loans.

How To Get Started In Self-Storage Real Estate Investing

Examine Your Financial Situation

The very first step before you make a real estate investment in self-storage is to examine your financial situation from a top-down perspective. The goal for most investors is for their investments to cover all of their living expenses. You should identify where you are in the stages of your financial life. The first stage is simply survival, which is where most people start. The later stages include stability, growth, and cash flow.

Keep in mind you need to examine the cash flow of the storage facility you are looking to purchase as well. You should go over the last 3 years of financial records and determine the annual cash flow. If cash flow is remaining steady or increasing, then this is probably a good sign the property is worth a closer look.

Economic Occupancy Information

The next step is to examine the economic occupancy information of a self-storage property. Economic occupancy information refers, in the storage industry, to physical occupancy and economic occupancy. Physical occupancy is the number of units currently being rented to the number of empty units. Economic occupancy refers to the difference between actual and potential profits. If a facility has 80% physical occupancy but only 50% economic occupancy, then the facility may have a lot of tenants who are paying under market value. Review this information in depth before making an offer.

Market Analysis

This step will require some deep diving and investigation on the investor’s part. To conduct a thorough market analysis, you should examine the general commercial real estate market within the area. This might include job and population growth. It might include the unemployment rate or the current number of commercial buildings on the market.

A pro tip is to look at the average number of occupied homes and their household size. A smaller home with a greater number of occupants will likely require outside storage. You can look at the number of rental properties situated near the area since most renters change their living situation more often than home buyers.

Examine the Competition

This stage is critical for a commercial real estate investment. You should examine all of the self-storage operators in the region to determine exactly who you will be going up against. Look at the competition and research their economic and physical occupancy rates to see if you can determine how your investment will play out. If the area where you want to open your facility is dominated by large REIT facilities, then it might be wise to look elsewhere. The competition will be tough for newcomers.

Secure Financing

Unless you plan to pay in cash, then you will need to secure financing. As we discussed before, financing can be secured through a few different avenues including SBA loans, conventional loans, and real estate crowdfunding. SBA loans offer the best rates and lowest down payments, but they often have a few additional requirements. You may also be able to get USDA loans and new construction loans if you want to develop a new facility.

FAQs

What is a good ROI on an investment property?

A good ROI on a residential investment property is around 10 to 12%. A great return on investment for rental properties is around 15%.

Can I get started in real estate investment without experience?

Yes, of course. That’s why you should hire the world’s best advisors to work with you when you are looking for your first investment property. We recommend putting together a team of real estate professionals and advisors to guide you. Kingdom Storage Partners, LLC can offer you the best advice on commercial real estate and self-storage investments.

Is real estate the best way to invest?

Yes! Real estate offers one of the best-annualized returns compared to stocks and bonds. Rental properties can offer you a passive income while your money is put to work for you. Real estate offers a high reward for a small risk.

Do self-storage investments hedge against times of recession or other crises?

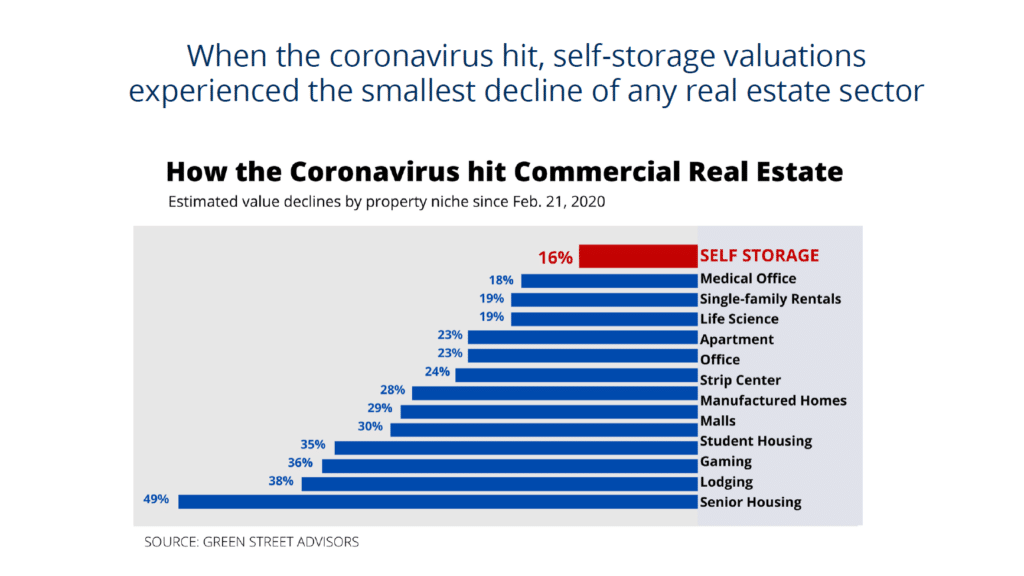

Yes, self-storage investments are a good investment regardless of the current state of the economy. Since storing your stuff is based on life events, people need a place to store things when they buy too much or reduce their living space. During the recent pandemic, self-storage experienced the smallest decline of all commercial real estate.

The Bottom Line

Real estate investment is an incredibly smart investment that can help your portfolio work for you. Self-storage investment particularly can bolster your portfolio by allowing you to gain a passive income, equity, and tax benefits. If you have not added a real estate investment opportunity to your portfolio, then you might not be getting the most out of your assets. Let Passive Storage Investing assist you by making your money work for you. Take the first step to dependable passive income and apply now.